#ICICI Bank CONNECTED BANKING

Holding an ICICI current account? If yes, then this blog is for you!

Did you know that there is an amazing feature within your ICICI account, which will simplify how you manage your money?

Surprisingly, recent surveys have shown that only 3 out of 10 ICICI current account holders are aware of this feature.

The feature we are talking about is “Connected Banking”.

ICICI Bank, One of India’s largest private banks partnered with business payments platforms like OPEN, to launch the “ICICI Bank Connected Banking” feature.

This unleashes the true potential of ICICI Bank current accounts and aims to solve the difficulties in daily business payment processes, an owner and their accountant might encounter.

“By 2030, banking will be invisible, connected, insights-driven, and purposeful.” – Forrester

What is ICICI Bank Connected Banking?

ICICI’s Connected Banking is an integrated platform where you can link all your ICICI Current accounts to OPEN, which further connects it to other accounting tools such as Tally, ZOHO, and Microsoft Dynamics.

Connecting your ICICI current account to OPEN using “connected banking” gives you full control and visibility over your cash flow, saving you hours of time.

What Does OPEN & ICICI Connected Banking Bring To The Table?

There are several aspects of running a business properly, from maintaining books of accounts to employee salaries, the tasks are endless.

So, let’s break it down a little.

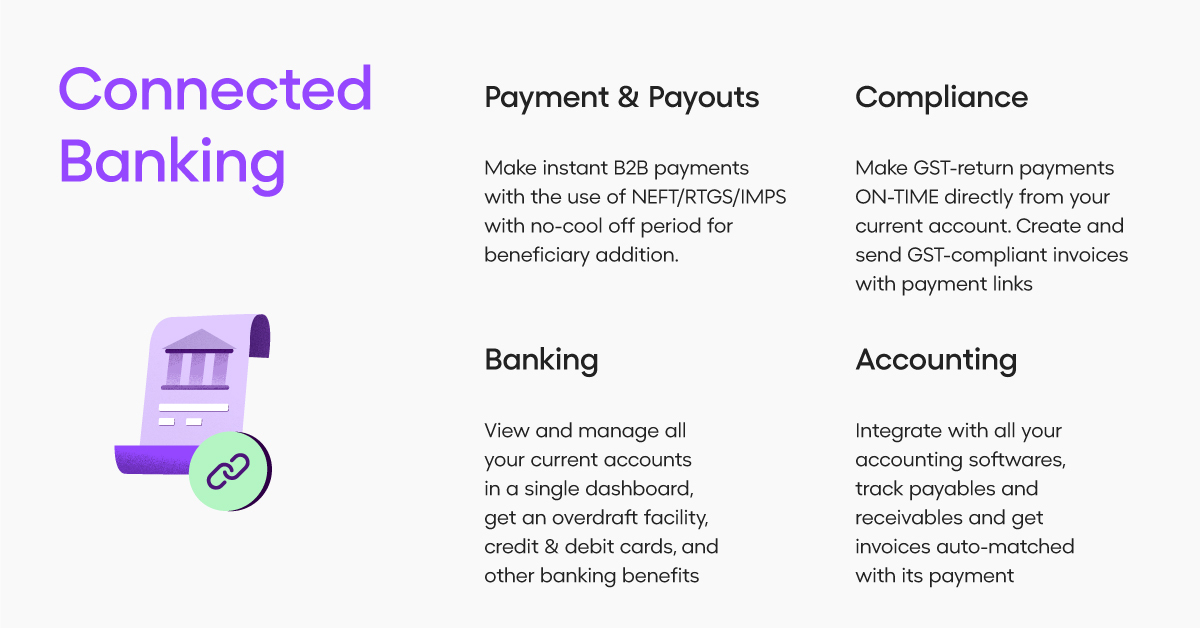

Broadly, a business can be divided into 4 fundamental pillars:

1. Banking

2. Accounting

3. Payments & Payouts

4. Compliance

Here’s how ICICI’s connected banking simplifies all of this.

Top Features of OPEN – ICICI Connecting Banking

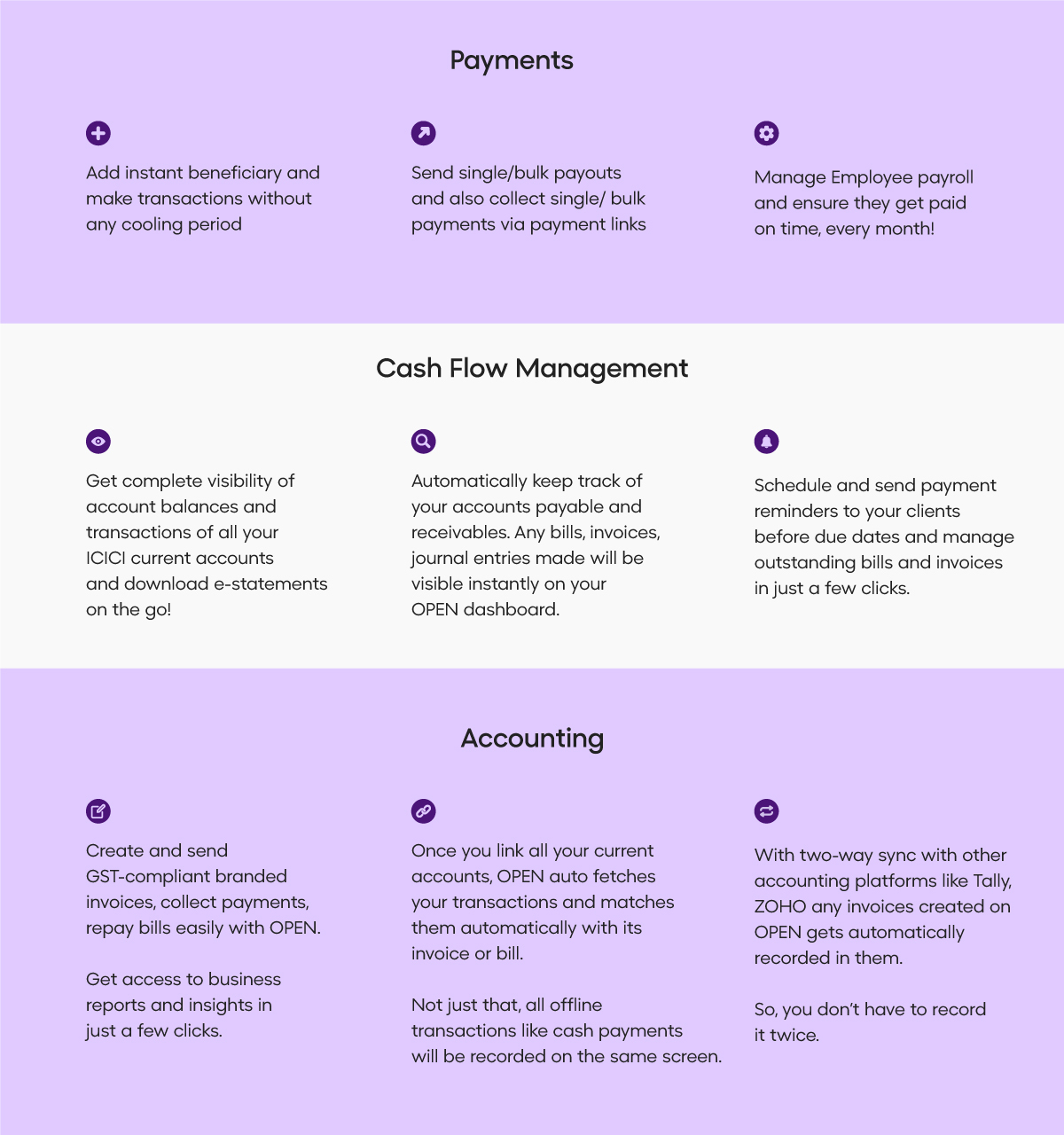

Now that we have understood the basics of managing a business, we can conclude that everything comes down to money, where it is coming from? Where is it going? Is there any more money yet to be received?

Money movement and management is the most important function of any business.

Having access to such information thus becomes the key to growing any business as well.

This is where Connected Banking plays a vital role as it bridges the gap between your current accounts where the money lies and the accounting books which tell where money should be.

Here’s how:

What’s more for ICICI current account users?

The OPEN – ICICI Bank partnership also offers several value-added services as well, which enable you to take complete control of your business’s finances.

These services include:

- Spend management: Track business and employee expenses with prepaid cards and give approvals instantly with OPEN

- Payroll: Monitor employee salaries, leaves, and pay from OPEN directly

- E-invoicing: Easily create e-invoices and generate IRN and pay directly from your current account

- GST filing: OPEN will calculate GST for inward and outward supplies with GSTR1 ready to file. Additionally, you can download GSTR 2A, GSTR 3B reports for verification.

Start your ICICI Connected Banking journey today! Sign up