Finance Automation, AP Automation, AR automation, Finance Processes

From being manpower intensive to technology-driven – the shift in finance processes is more evident than ever today. Research shows that for finance functions in every industry, at least 42% of all activities can be fully automated, with a further 19% able to be mostly automated.

“Automation is cost-cutting by tightening the corners and not cutting them,” says Haresh Sippy, the founder and managing director of Tema India Ltd.

You hire finance people for their expertise, ideas, and zeal, not their ability to perform mundane, repetitive finance tasks. Today, there’s automation and AI to handle that. Automating specific manual tasks brings efficiency, cost savings, standardization, transparency, and other benefits.

Investment in automation is an investment in people. Forrester Research found that 57% of surveyed companies reported better employee engagement after implementing RPA (Robotic Process automation).

The software can automate a number of finance functions, but first, let’s discuss what finance automation is.

What is Finance Automation?

Finance automation can help businesses handle manual, repetitive tasks that are complex, time-consuming, and boring to bring operational efficiency, standardization, and transparency.

Automation provides an additional edge over competitors by providing financial insights and analytics to help finance departments direct their efforts toward value creation and strategy building.

Finance automation leverages machine learning, artificial intelligence, and RPA to automate core finance functions. From invoicing to spend management to financial accounting and reporting, finance automation lets you focus on more critical aspects of finance, such as planning and analysis.

Which Business Finance Processes Can Be Automated?

Finance processes can get complex and daunting at times, but they needn’t be complicated. Finance automation can streamline and simplify multiple finance touch-points and workflows.

Here are 5 key areas finance automation can transform:

(i) Accounts Payable

Managing your company’s accounts payable responsibly and timely is a critical yet tedious job. Accounts payable involves processing invoices, sending them for approval to the correct team or person, and processing the payment while recording each discrete step.

CFOs realize savings and risk mitigation come through early payments and discounts and keeping a check on processing time. That’s where AP automation comes in.

Automating invoicing and expense management can improve finance processes by increasing accountability, saving time, and ensuring accuracy. It also standardizes and removes bottlenecks and backlogs from AP processes.

The range of technology solutions available today helps handle:

- Digital bill capture

- Notification requests for approval

- Sending approved bills for payment

- Invoice-purchase order matching, and

- Reading and syncing invoices with accounting software for reconciling payments easily.

AP automation helps with cost savings and strengthens supplier relationships over time. It connects the accounts payable system to purchasing workflows to process only approved invoices. You can manage multiple current accounts for a connected banking experience and streamlined vendor payments.

Automation can also help in budget management by integrating accounts payable workflows with financial planning tools for automatic budget allocation.

Recommended: All You Need To Know About Accounts Payable Automation

(ii) Accounts Receivable

If finance is the lifeblood of an organization, accounts receivable workflows are the circulatory system carrying that lifeblood. Accounts receivables bring the revenue streams via issuing and tracking invoices and ensuring timely payments.

Unsurprisingly, the majority of small businesses remain unpaid. Unpaid invoices in the U.S. amount to $825 billion, and the average wait time for an invoice is 72 days.

Moreover, the processes get erroneous and time-consuming. So much would depend on perfect coordination across different teams – sales, finance, customer services, etc.

Automating accounts receivables can help:

– Streamline customer onboarding

– Manage recurring invoices

– Check for late payments and

– Send payment reminders.

Thanks to AR automation, there’s no need to track payment deadlines or follow up with delays. The invoices get automatically generated, reconciled against accounts, and paid on time. The debtors and customers also get prompt reminders for the arriving payment dates.

(iii) Accounting & Reconciliation

You don’t hire employees to soak them up in clunky bookkeeping and accounting processes. Tallying invoices with account books and reconciling Excel sheets – if your finance team is still doing these, you are living in the Stone Age.

80% of manually generated Excel sheets contain gaps and errors!

Finance automation replaces outdated accounting processes with technology solutions to ensure consistency, accuracy, standardization, and transparency in your accounting books.

Xero, Freshbooks, Quickbooks, and Zohobooks are a few modern accounting software that automates accounting and reconciliation processes for businesses. The software ensures books are ready to use, accessible, and understandable by all.

Automating data collection, recording, and reconciliation in real time improves decision-making and increases the utility of business data. Data from multiple sources can be consolidated and reconciled with minimal human intervention. There are also fewer chances of fraud or misappropriation.

Real-time analytics, financial reports, and dashboards are accurate, comprehensive, and compliant, providing improved financial insights.

(iv) Expense Management

A business incurs expenses daily across departments, processes, and functions. Let’s not forget to consider the different expenses within a workflow. It can get expensive and frustrating keeping a tab on each petty expense and big capital expenditure.

The steps involved make the process even more complicated – employees collect receipts and fill expense reports, managers approve them, and the finance team matches every invoice to book entry and process the reimbursement.

CFOs can deal with expense management using integrated tools and connected banking solutions like OPEN. Such tools automate recording, reconciling, and processing expenses to ensure prompt payment and matching claims.

A good spend and expense management software can help automate processes, such as:

– Corporate cards with in-built budgeting

– Fully automated credit control processes

– Proactive management of business expenses and budgets

– Automation of expense reports and the approval process

Automatic expense management software provides real-time visibility via a single dashboard, combining expense information accurately across the organization.

(v) Payroll

Yes, a timely payroll check is the first of many employee engagement hacks you employ to keep your staff happy and motivated to put their best foot forward. But salary disbursal isn’t just a credit-debit entry in those books of accounts.

Payroll management can be the most complex and tasking of the finance processes. A payroll structure for any organization involves several levels of entitlements, superannuation, leave policies, fringe benefits, and so on.

Modern businesses cannot do without dedicated payroll management software. There are software solutions like PayFit, Bamboo HR, etc., to save you from an eternity of poring over payrolls.

Automating payroll takes a huge chunk of work off your already-full plate each month. There’s no need for back-and-forth reconciliation and streamlining payroll with HR operations. You can scan the books and look for inconsistencies or revisions, facilitating instant salary disbursements.

What Are The Benefits of Finance Automation?

While we discussed the benefits of automating each process separately, there’s no harm in summarizing the advantages of finance automation once more.

- Automating manual, repetitive tasks can save valuable time, cost, and effort, which can be used to fulfill more critical responsibilities and roles.

- Automation ensures automatic and accurate data recording, reconciling the same, and integrating it within and across workflows for greater accuracy, consistency, and speed.

- Transparency and automatic reconciliation are two of the biggest advantages of finance automation. When workflows and processes require minimum human intervention, the chances of errors, fraud, and misappropriation are reduced.

- Finance automation technology solutions and software are programmed in compliance with the most up-to-date laws and regulations relevant to a specific business or jurisdiction.

Want to learn more about Business Finance Automation & how are CFOs evolving?

Visit – https://register.open.money/business-financial-automation-ebook/

Finance Automation Should Precede Integration

Suppose you automate your financial processes using the best automation software out there. But what would you do with a bunch of automated processes siloed and not talking between themselves?

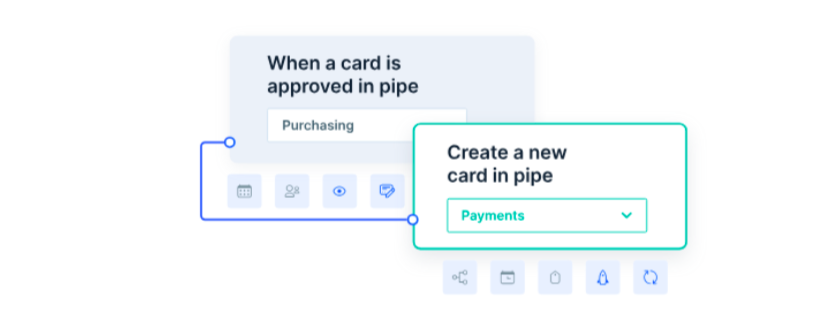

Automation should follow integration. Each automation process should be integrated to ensure free communication and information sharing. A single source of truth is pertinent to keep the organization moving and in tandem.

OPEN empowers finance teams to do their best by automating and integrating multiple finance processes across departments while integrating in-house software for inventory management, procurement, etc.

OPEN’s connected banking solution offers a unified interface for SMEs and MSMEs to make payouts and collect payments effortlessly, reconcile accounts, and invoke compliant payment-linked embedded invoices all in one place.

You did not hire finance teams to slog through copy-pasting data between Excel sheets. Make better use of them; automate finance processes. That’s how the race for survival will be won. Remember, half of the Fortune 500 companies don’t exist today because they never automated!